This policy is used to determine eligibility for IV-E foster care and adoption maintenance payments and Medicaid assistance through the coordination of the Economic Assistance and Social Services units. That collaboration ensures eligibility requirements are met, monitored and maintained.

| 6 and 12-Month Review Hearings

Chapter 12 B, Chapter 13 G.3, Chapter 15 |

Medicaid

Chapter 2V. Chapter 3R, Chapter 14 I.C&D, Chapter 15 I.C, Chapter 17 |

| Adjudicated Delinquents

Chapter 5 L |

Minor Parent

Chapter 5 J |

| Age/Aging Out

Chapter 14 I.D, Attachment 2 |

Need Standard

Chapter 9, 10 & Table VI |

| Assets

Chapter 5 E, Attachment 2 |

Notice

Chapter 14 |

| Background Checks

Chapter 6 D |

Out-of-State Placement

Chapter 3 R, Chapter 5 I |

| Case Transfer

Chapter 15 IV, Chapter 19 IV |

Periodic Reviews

Chapter 3 R, Chapter 13 D & J, Chapter 15 |

| Certification

Chapter 6 |

Permanency Hearing

Chapter 7, Chapter 12 A. 7. & B, Chapter 13 E, Chapter 15 I.C.5, Chapter 19 V. Alert 2 |

| Citizenship

Attachment 1, Attachment 2 |

Placements

Chapter 5 |

| Compliance File

Chapter 19 VI. |

Quality Assurance (QA)

Chapter 19 II. |

| Confidentiality

Chapter 1, Chapter 2 |

Reasonable Efforts

Chapter 7 I.B., Chapter 15 III. C. |

| Contrary to the Welfare

Chapter 7 I. A, Chapter 15 III. C. |

Reimbursable

Chapter 6, Chapter 10, Chapter 11 F & G, Chapter 19 V Alert 2 |

| Coordination Meetings

Chapter 13. G & N, Chapter 19 |

Removal From Home

Chapter 4, Chapter 9 II., Attachment 2 |

| Correcting Errors

Chapter 19 III |

Runaways

Chapter 5 K |

| Court Order Sample

Attachment 3 |

Sponsor of Immigrant

Chapter 3 N.6, Chapter 9 II.B.2.c |

| Compliance File

Chapter 19 VI. |

SSI Children

Chapter 3 P |

| Contrary to the Welfare

Chapter 7 I. A, Chapter 15 III. C. |

Stepparent

Chapter 9 II.A.3, B.1.d, C. |

| Deprivation

Chapter 5 E, Attachment 2 |

Time Frames

Chapter 2, Table 1 |

| Deprivation

Chapter 5 E, Attachment 2 |

Trial Home Placement

Chapter 5 H, Chapter 11 E |

| Immigrant

Chapter 9 I.C, II, B1.d, C.2.b and c |

Voluntary Placements

Chapter 5 F, Chapter 7 III. A., Chapter 11 C & D, Table III |

| Income

Chapter 5 E |

Voluntary Relinquishment Chapter 5 G, Chapter 7 III. B., Chapter 11 D |

I. INTRODUCTION

This policy is used to determine eligibility for IV-E foster care maintenance payments and related Medicaid assistance through the coordination of the Economic Assistance Division, Protective Services Division and Juvenile Services Division. The team approach is important to ensure eligibility requirements are met, monitored and maintained.

II. AUTHORITY

Regulations: IV-E P.L. 104-193, as amended by P.L. 105-33; U.S. Code Title 42, Chapter 7, Subchapter 4, Part E, “Federal Payments for Foster Care and Adoption Assistance.” Title IV-E of the Social Security Act provides Federal funding for foster care maintenance for children who meet eligibility and reimbursabilty criteria. Title IV-E also provides funding for administration and training for the foster care program.

Eligibility requirements for IV-E as established under Public Law 96-272, the Adoption Assistance and Child Welfare Act of 1980, became effective June 17, 1980. It amended Title IV of the Social Security Act to establish a new Part E, which provides for federal payments to the states for foster care maintenance and adoption assistance payments, including administrative and training payments. ASFA (The Adoption and Safe Families Act) was signed by President Clinton on November 19, 1997, which further defined federal regulations necessary to claim these funds and to ensure permanency for children. Title IV-E eligible children are categorically eligible for Medicaid.

The Administration for Children and Families (ACF) is the federal agency that sets regulations and monitors the Title IV-E foster care and adoption programs. Title IV-E is administered by the Department of Family Services. The agency acts as an applicant for the child and provides Title IV-E foster care payments to providers on behalf of eligible children within:

- the guidelines established by state and/or federal legislation for the program; and

- the established standards of the AFDC program in effect July 1996. D.All records are confidential. No person shall disclose, receive, use or

- knowingly permit or participate in the use of information from records maintained pursuant to law or acquired in the performance of duties for purposes not directly related to case work and administration. Refer to Wyoming Statutes 14-2-111, 14-3-124,14-3-437, 14-6-203, 14-6-239, 14-6-437, and 16-4-203 for further information on confidentiality and safeguarding information.

III. Overview of Title IV-E Foster Care

- Covered Expenses

Title IV-E benefits are individual entitlements for a qualified child in out of home care. The Federal government shares in the cost of:- Maintaining the child in out of home care (includes the room, board, and other maintenance and supervision costs for certified foster parents, child care institutions, shelter care providers, and group homes.)

- Administering the foster care program, including staff and administrative costs incurred when working with the child, the child’s family, and the care providers.

- Training staff that work with the child, including foster parents or those who administer the foster care system for the child.

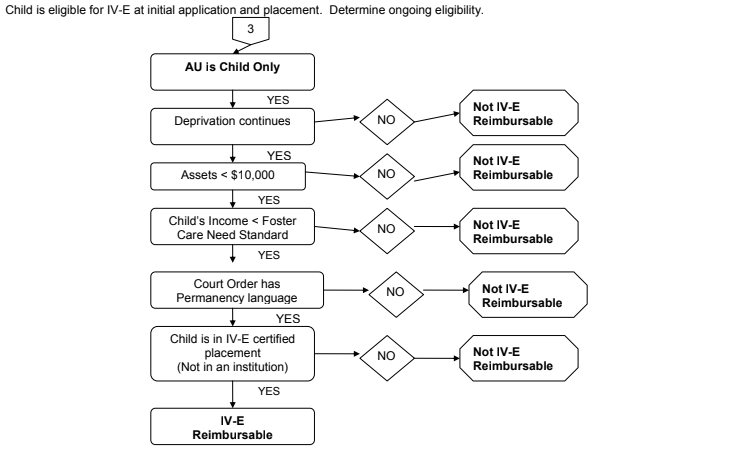

- Title IV-E Eligibility and Reimbursability for Foster Care

A qualified child enables the State to collect Title IV-E funds in two ways:- IV-E Eligibility: The determination for Title IV-E eligibility qualifies the State to obtain IV-E reimbursement for administrative and training costs associated with the child.

- IV-E Reimbursability: The determination of IV-E reimbursability qualifies the State to also obtain IV-E reimbursement for foster care maintenance cost (such as room, board, or clothing) associated with the child. A child is also categorically eligible for Medicaid when IV-E eligible and reimbursable.

- For purposes of Titles XIX and XX, any child with respect to whom foster care maintenance payments are made under this section will be deemed a dependent child as defined in section 406 of the Act (as so in effect 7/16/1996) and shall be deemed to be a recipient of aid to families with dependent children under Part A of the this Title (as so in effect 7/16/1996). Titles XIX and XX services will be available to such child in the State in which the child resides.

IV. DEFINITION OF TERMS

Adoption and Foster Care Analysis & Reporting System (AFCARS) – is a federally mandated electronic data collection system used by the states to collect and transmit to the federal agency selected data elements with respect to children in foster care and children who have been adopted under the auspices of the state child welfare agency. Its purpose is to ensure that federal requirements related to standards of care for foster and adopted children are met by states. Wyoming has WYCAPS and EPICS to electronically capture data.

Adjudicated delinquent – is the pronouncement of a judgment or decree by a court regarding a juvenile.

Adoption and Safe Families Act (ASFA) – is a federal legislation passed on November 19, 1997, intended to strengthen Titles IV-B and IV-E of the Social Security Act. It required greater accountability on the part of states for the safety, permanency, and well-being of children in the state’s foster care and adoption programs through the achievement of such outcomes as shorter stays in foster care, and increased number of adoptions, and safer placement of children.

AFDC/AFDC-UP - Aid to Families With Dependent Children program and Aid to Families With Dependent Children - Unemployed Parent program. Eligibility for IV-E is to be based on policy for these programs in effect on 7/1/96.

Affidavit – is a voluntary statement or declaration of facts, written or printed and sworn to by the person making it before an office authorized to administer oaths.

Asset – is all real and personal property owned by a person including money on hand the first moment of the first day of the month.

Assistance unit - persons living together whose income and assets must be considered in determining eligibility and benefit level.

Basic foster care – is a Medicaid foster care group. This coverage group is100% funded with State dollars. This Medicaid category is used when a foster child does not meet any other Medicaid foster care group.

Behavior Rehabilitation Services Facility (BRS) – provided to children to remediate debilitating disorders upon the certification of a physical or other licensed practitioner of the healing arts that the services are medically necessary for the child. These services are billable to Title XIX if the child is eligible. Maintenance payments for the child while s/he receives these services may be charged to Title IV-E if the child is eligible.

Boarding home – is the same as group home.

Budgeting – the act of calculating the amount of money to be paid to the assistance unit to meet its needs for a given month.

Candidate – for foster care is a child who is at serious risk of removal from home as evidenced by DFS either pursuing his/her removal from the home or making reasonable efforts to prevent such removal.

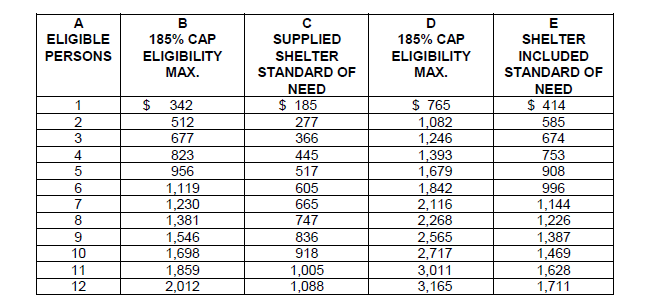

CAP - the income limit established by the Federal government as one of the prospective eligibility tests and is 185% of the standard of need.

Care and Control – when a parent or caretaker relative can be counted on to function in planning for and/or is giving the child(ren) physical care, guidance, and maintenance.

Case plan (also known as a Family Service Plan) – a plan developed jointly with the parent(s) or guardian(s) of a child in foster care. The plan describes the services offered and provided to prevent removal of the child from his/her home and/or reunification. Such description should include whether or not services to the family have been accessible, available and appropriate.

Caseworker – the DFS social worker or probation officer.

Central Registry Check– is the process of examining the Wyoming Department of Family Services computer system to determine if an individual has been involved in an incident involving maltreatment of a child or disabled adult and is listed as being on the Central Registry.

Certified foster care facilities/placement - those facilities certified by DFS to care for children and meeting the standards established for such certification to include a non-relative foster family home, a relative family foster home (not the parent(s)), group home, public institution of 25 children or less or a private non-profit institution.

Child – a person between birth and 18 years old. For IV-E purposes may be age 18 if graduating before age 19.

Child Care Institution – a private child care institution, or a public child care institution which accommodate no more than 25 children, and is licensed by the State in which it is situated or has been approved by the agency of such State or tribal licensing authority (with respect to child care institution on or near Indian reservations) responsible for licensing or approval of institutions of this type as meeting the standards established for such licensing. This definition must not include detention facilities, forestry camps, training schools, or any other facility primarily for the detention of children who are determined to be delinquent.

Child Placing Agency (CPA) - Any private person, partnership, cooperation, association, agency or other entity that arranges for the permanent placement or temporary care, maintenance and supervision of children in a place other than the home of their parents or relatives. Verification of the CPA’s foster home certification and background check are required for IV-E purposes.

Children In Need Of Supervision (CHINS) – provision is made for the care

of children age twelve (12) through sixteen (16) who are beyond the control of their parents, have run away, have substance abuse problems, or other high risk behaviors or whose parents are unable, unwilling or unsuccessful in providing for their basic needs.

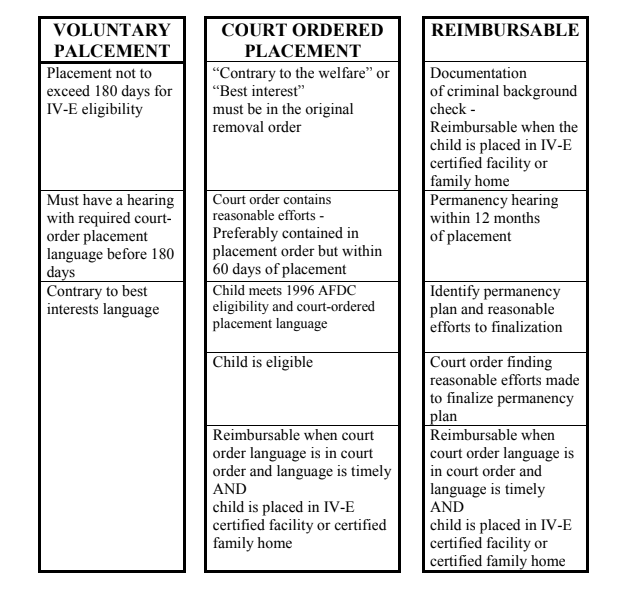

Contrary to the Welfare (CTW) – “Contrary to the child’s welfare” commonly referred to as CTW, is a judicial protection mandated by federal laws to eliminate the unnecessary removal of a child from the home and the accompanying trauma to the child. This protection is in the form of a court finding and must be entered in the very first court order directly leading to the removal of the child from the home. The language of the finding must be to the effect that it would be contrary to the welfare of the child to remain in his or her home. Failure by the court to make this determination in the initial removal order renders a child ineligible for Title IV-E funds for that entire placement episode.

Constructive removal – “Constructive removal” is a federal term referring to the legal removal (though not necessarily the physical removal) of a child from his or her non-parental home which meets Title IV-E eligibility requirements. In such cases, if the child has lived with his or her parent(s) within six months of the petition to the court or the signing of the court order or VPA which initiates the legal removal, the child is considered to be removed from the parent. The child may remain with the person with whom s/he was living or be placed in a certified foster care. The removal is still considered to be from the parent.

Court order – is an order issued by the court and used to determine necessary enforcement action.

Court order date – is the date of the hearing as stated within the court order. If the date of the hearing is missing from the order, then it is the date on a court order that has been signed by or has the name stamp of the judge/commissioner who presided at the hearing. The county clerk’s date file stamp is also accepted.

Criminal history check – is an investigation of a prospective foster or adoptive parent’s or a relative’s personal history to discover any criminal convictions that may indicate a threat that the individual could pose potential danger to children. This also includes staff of licensed facilities. Persons convicted of certain crimes cannot be certified or approved either permanently or for a period of five years, depending on the specific conviction.

Custody – is the legal detention of a person; the care and control of a child.

Custody episode – See Placement episode.

Deprivation – at the time a child is removed when a parent(s) or caretaker(s) is not providing care and control of a child(ren) or cannot be counted on to function in planning for the physical care, guidance and maintenance of the child due to death, continued absence, incapacity or unemployment.

DFS-FO – is the Department of Family Services Field Office.

DFS-SO – is the Department of Family Services State Office.

EITC (Earned Income Tax Credit) - an amount of money either deducted from the taxes owed or paid as a refund resulting from filing a Form 1040 or 1040A tax return for a calendar year.

Employment – full-time is 35 or more clock hours for the week. Part-time is less than 35 hours per week. For unemployed parent deprivation factor it is less than 100 hours per month.

Family Service Plan – See Case Plan.

Federal Financial Participations (FFP) – the portion of federal funds used to pay for public assistance programs

Foster care - the term used by DFS when a child is in state custody. Foster care is 24-hour substitute care for children placed away from their parent(s) or guardian(s) and for whom the State agency has placement and care responsibility. This includes, but is not limited to, placements in foster family homes, foster homes of relatives, group homes, emergency shelters, residential facilities, child care institutions, and pre-adoptive homes regardless of whether the foster care facility is certified and whether payments are made by the State or local agency for the care of the child or whether there is federal matching of any payments that are made. CFR 1355.20 – 45.

Foster care provider - the facility or person(s) caring for the child(ren) in

DFS custody placed in their care and certified/approved by DFS.

Foster family care - is provided on a 24-hour basis for up to six children in the certified family home of the person(s) under whose direct care and supervision the children are placed.

Foster family home – For the purpose of IV-E eligibility, foster family home is the home of an individual or family certified or approved as meeting the standards established by the certifying unit that provides 24-hour substitute care for children.

The definition may include group homes if the facility is the personal residence of the foster parents. Foster family homes or relatives that are certified must be held to the same standards as foster family homes of non-relatives that are certified.

Title IV-E funded foster payments may be made only to homes that are fully certified.

Full certificate – refers to a foster certificate that satisfies all requirements established by the state for licensure or approval. Only a fully certified foster home may receive Title IV-E funding. If a foster home is fully certified for one day during a month it is considered for the entire month for Title IV-E reimbursability.

Group Home – is a home-like, community-based program, where the residents may attend public school, work in the community, and have access to their support systems.

Household composition – a group of persons residing together whose income, assets and needs must be considered when determining eligibility for IV-E.

Housing Subsidy – any government financial assistance offered to an assistance unit for shelter costs such as, but not limited to, that under the U.S. Housing Act of 1937, the National Housing Act or the Department of Housing and Urban Development (HUD), which includes Indian and public housing section 8 new and existing rental housing and section 236 rental housing.

Income -

- Countable income - the amount of income used to determine eligibility for assistance after application of the appropriate disregard.

- Earned income - payment received in cash or in-kind for wages, salary, tips, commissions as an employee or net-profit from activities in which the individual is engaged as self-employed.

- Exempt income - money set aside or free from program policy or limits.

- Unearned income – all money received that is not earned by providing good and services or defined as an asset.

Institution – See Child Care Institution

Interstate Compact on the Placement of Children (ICPC) - an agreement between states to ensure protection and services to children who are placed across state lines for foster care or adoption.

- The Compact establishes orderly procedures for the interstate placement of children and assigns responsibilities for those involved in placing the child.

- The Compact does not include placements in a medical facility, a boarding school or a mental health or mental retardation facility.

Involuntary foster care - placement of a child into foster care without parental consent by order of the court or by temporary protective custody (48 hour hold) consistent with W.S. 14-3-208.

IV-E Administrative costs/payments – costs necessary for the administration of the IV-E foster care program.

Judicial determination – is the final determination or adjudication by a court of the rights and claims of the parties of the action; the sentence or final order of the court.

Legal guardianship – is a judicially created relationship between child and caretaker which is intended to be permanent and self-sustaining as evidenced by the transfer to the caretaker of the following parental rights with respect to the child: protection, education, care and control of the persons, custody of the person, and decision-making.

Maintenance payments – are payments made on behalf of a child eligible for Title IV-E foster care to cover the cost of food, clothing, shelter, daily supervision, school supplies, a child’s personal incidentals, liability insurance with respect to a child, and reasonable travel for a child’s visitation with family, or other caretakers. (475(4) of the Social Security Act)

Minor parent - a mother or father who is under the legal age of 18 and not emancipated according to the Tax Reform Act of 1986. (Public Law 99 514)

Non-relative foster family home – a private home in which care is provided on a 24 hour basis for not more than five children excluding the foster parents' own children. No more than two infants under two years of age shall be placed in one foster home.

Out-of-state placement – See ICPC – Interstate Compact on the Placement of Children.

Parent – a natural or adoptive mother or father of any age. Under 14-2-

102(a)(iv) of the Wyoming State Statutes, a person is presumed to be the father when he openly holds out the child to be his natural child.

Payment standard - the budget test in which the countable income of the AFDC unit is subtracted, adjusted by household size, and arrived at by applying the ratable reduction to the standard of need.

Penetration rate – is the percentage of children in the foster care population who are Title IV-E eligible.

Permanency hearing – is federally mandated and must be held within 12 months from the original placement date and every 12 months thereafter to determine whether:

- The child will be returned to the parent or legal guardian;

- Placed for adoption (with DFS filing a petition to terminate parental rights) Referred for legal guardianship, including dependency guardianship and 3rd party custody;

- Be placed with a fit and willing relative that will lead to the finalization of permanency through reunification, adoption, or legal guardianship/third party custody;

- Be placed in another planned permanent living arrangement; Provided the services of the Independent Living program.

Placement episode – refers to the time during which a child is in DFS custody and placement. It begins when a child is removed from their home and enters placement outside the home through a court order or voluntary placement. It may involve any number of separate placements, but ends when the child is returned to their home and/or DFS custody is ended. Title IV-E episode – refers to the time during which a child’s out-of-home placement is Title IV-E eligible but not necessarily always reimbursable; it may begin with and include periods in which the child is not reimbursable for IV-E.

Principal wage earner (PWE) - the parent who earned the most gross income in the family unit as demonstrated by tax and wage information from the previous two years (24 months) starting with the month before application. (applies only for the Unemployed Parent program.)

PRWORA - Personal Responsibility and Work Opportunity Reconciliation Act of 1996. This act established comprehensive new restrictions on the eligibility of legal aliens for means-tested public assistance. It further restricts public benefits for illegal aliens and non-immigrants.

Public institution - the public institutions in Wyoming include, but are not limited to, the State Penitentiary, Women’s Center, State Hospital, Wyoming State Training School, Honor Farm, Girls’ School, Boys’ School, Pioneer Home, city/county jail facilities and any other facility which is government operated or contracted to operate under government administration.

Ratable reduction - the percentage by which the standard of need is reduced, as set by the State Legislature and effective 7/1/93, to establish a payment standard, adjusted by household size.

Reasonable efforts – the federal government requires states to make reasonable efforts to prevent the removal of children from their homes, to reunify children with their families if removal has been necessary, and to find other permanency solutions when reunification is not possible. Judicial determinations that such efforts were made must occur within prescribed timeframes. Given that the child’s health and safety must be the primary concern when making those efforts on behalf of a child, the court may find that DFS is not required to make reasonable efforts to prevent the child’s removal or to reunify the child and family if aggravated circumstances exist. Eligibility for Title IV-E reimbursement is maintained if such a finding is made.

Reimbursement -

- Repayment by the federal government for a portion of the costs of maintaining a IV-E foster child, staff, and administrative costs which are incurred when working with the child or the child’s family and the care provider;

- Also, repayment of a percentage of the costs of training state staff who work with the child or who administer the foster care system for the child.

Reimbursability/Reimbursable – A child who is initially determined IV-E eligible and who meets IV-E eligibility placement requirements is IV-E reimbursable. Once a child is determined IV-E eligible, s/he may lose and regain reimbursement on a frequent basis depending on changes in the child’s circumstances or placement.

Relative – a specified relative is a person who is any blood relative, including those of half-blood. First cousins, first cousin once removed, aunt or uncle, nephews and nieces and persons of preceding generations denoted by prefixes of “grand,” “great,” “great-great,” or “great-great-great,” are included in this definition;

- Stepmother, stepfather, stepbrother, and stepsister;

- Adoptive or natural parent and their adopted or natural children; Siblings, including those related by adoption;

- Spouses of any person mentioned above are considered relatives even though the marriage may be terminated by death or divorce.

Removal – taking a child from his/her current living situation either as a protective custody decision, voluntary placement, or court order.

Removal Household – members living in the home who are responsible for the child and the child’s siblings. I.e., parents, step-parents. Step-siblings, half-siblings. This could be the grandparents or aunts/uncles if the child was judicially removed from their home.

Removal Home – the home the child was voluntarily or judicially removed from regardless of where s/he was living at the time taken into placement.

Residential treatment facility (RTC) - a group setting for ten and no more than 50 children age six and above who require a structured environment and treatment program. RTC is a program of service for children who require a combination of therapeutic, educational, and treatment services in a residential group care setting.

School attendance –

Elementary or secondary school student means, with respect to a child, that the child is

- Enrolled (or in the process of enrolling) in an institution which provides elementary or secondary education;

- Instructed in elementary or secondary education at home in accordance with the State at home school law;

- In an independent study elementary or secondary education program in accordance with the law of the State; or

- Incapable of attending school on a full-time basis due to the medical condition of the child, which incapability is supported by regularly updated information in the case plan of the child.

Full-time is:

- 25 clock hours per week in a secondary school or program such as an alternative high school; or

- In a post-secondary, vocational or technical school, the amount of time established by the institution as full-time.

Half-time is:

- 12 clock hours per week in a secondary school or secondary education program such as an alternative high school; or

- In a post-secondary, vocational or technical school, the amount of time established by the institution as half-time.

Shelter/Group home care - a group setting for not more than ten children age ten through 18 including the staff's own children providing a planned period of substitute care and a planned program of group living, community experiences and specialized services for a small group of children.

Shelter included – the AFDC payment levels used when the assistance unit pays any portion of their own house and/or utility cost except the assistance unit receiving a housing subsidy.

Shelter supplied – the AFDC payment levels used when all housing and utility costs are provided to the assistance unit without cost and for the assistance unit that receives a housing subsidy.

Standard of need (Payment standard) - the dollar amount set by the State Legislature, effective 10/1/90, allotted for the needs of the person for one month for shelter and/or food, clothing, personal needs, etc.

State foster care – is when the child is under 18 or if 18 is a full-time student expected to graduated before 19, is a US citizen, is not living with his/her parents and is not an inmate of a public institution. The child’s countable income is less than $765 monthly. This child is eligible for full Medicaid benefits. This coverage group is funded with Federal dollars.

Subsidized adoption – is the granting of a definite amount of financial assistance to an approved adoptive home in the adoption of a special needs child.

Therapeutic Foster Care (TFC) – is a family-based, intensive treatment foster care program for severely emotionally disturbed youth. (i.e., Peak Wellness, Central Wyoming Counseling Center) and they recruit, train and approve their own foster homes. In the child’s placement record on WYCAPS, the name of the TFC program is given – not the name of TFC’s approved foster family. Therefore, verification of the TFC’s certification and background checks are required for IV-E purposes.

Title IV-E of the Social Security Act – became effective October 1, 1980. It provides federal financial assistance to states for certain AFDC eligible children who are removed from their homes and placed in foster care. It also provides funding for children who are candidates for foster care as defined by a written case plan, which clearly indicates that absent effective preventive services, foster care is the planned arrangement for the child. Title IV-E reimburses states for roughly 50 percent of the maintenance and administrative costs of eligible foster children. It also reimburses 50 – 75 percent of training costs.

Trial home visit – a child may be at home on a trial home visit and maintain Title IV-E eligibility in the foster home. A trial home visit does not terminate the placement episode. The child remains IV-E eligible although reimbursability ceases for the duration of the trial home visit. A trial home visit must be documented in the case plan and cannot exceed 6 months without a court order to extend it beyond the 6 months.

Voluntary foster care - a child(ren) placed in foster care voluntarily through a signed and dated Voluntary Placement Agreement (SS -11) by the parent or caretaker, caseworker, supervisor and manager for a temporary period of time. It must specifically name the child to be placed and, at a minimum, specify the legal status of the child and the rights and obligations of the parties while the child is in placement.

- IV-E payments for voluntary placements cannot be made for more than 180 days unless there has been a judicial determination by a court that the continued placement is in the best interests of the child;

- IV-E maintenance payments and POWER payments based on temporary absence CANNOT run concurrently.

Voluntary placement agreement (VPA) - is a written document executed by both DFS and the child’s parent(s) or legal guardian(s). It must specifically name the child to be placed and, at a minimum, specify the legal status of the child and the rights and obligations of the parties while the child is in placement.

Voluntary relinquishment – is a voluntary action on the part of the parents that transfers the parental rights over their child to the state, a private child placement agency or individual empowered by statute to assume these rights.

| WYOMING DEPARTMENT OF FAMILY SERVICES |

CHAPTER: 2 |

| IV-E Foster Care Policy Manual | SUBJECT: Application Process |

| POLICY NUMBER: IV-E–11-001 | EFFECTIVE DATE: 07/01/11 |

APPLICATION PROCESS

Regulations: IV-E P.L. 104-193, as amended by P.L. 105-33

I. Caseworker Responsibilities

Refer to Family Services Manual Chapter Funding 6.2 Child Support for Child in Out-of-Home Care

- Individual case workers will promptly notify their local benefit specialist of all children entering foster care and provide the following information: Child’s name, Date DFS gains custody of child, Child’s birth date, Child’s social security number, and where child is placed. Preference is notification by email.

- The Caseworker will initiate the application process within seven (7) working days, (see note at end of this chapter), from the date the child is removed from the home by submitting to the Benefit Specialist the following forms/verifications:

- Application for benefits, form SS-501A Placement Application, which must be signed by the appropriate manager or designee since s/he is acting as the child's guardian.The SS 501A will be returned to the Caseworker if it is not fully completed. (At no time is the Benefit Specialist to sign an application as the applicant);

- If there has been a court order, YES, a IV-E application must be processed, even if we know it will be denied for IV-E purposes. Reasons this might occur are: the court has given DFS legal and physical custody of the child and the child is placed with their parent; the family has excess income or resources; no deprivation; etc.

- If there has not been a court order, NO, a IV-E application is not needed. This would generally occur when a child is removed and within the 72 hours the child is returned home and the situation does not get to court.

- A copy of the SS 611 form(s), Temporary Authorization for Medical Services for Children, if the child required medical services prior to the date of application.

- A copy of the SS 11 Voluntary Placement form, when applicable.

- The DFS-FO Caseworker will initiate the application process within seven (7) working days from the date the IV-E eligible ICPC child is placed by submitting to the Benefit Specialist verification from the sending state the ICPC child is IV-E eligible.

- Application for benefits, form SS-501A Placement Application, which must be signed by the appropriate manager or designee since s/he is acting as the child's guardian.The SS 501A will be returned to the Caseworker if it is not fully completed. (At no time is the Benefit Specialist to sign an application as the applicant);

- Within 15 days of removal from the home the Caseworker will meet with the parents/caretakers and complete the Child Support form DFS 543. The caseworker will complete the DFS 543 on every child taken into DFS custody for each parent including deceased parents. The caseworker will submit the completed forms to the Benefit Specialist:

- Child support forms must be signed by the appropriate manager or designee since s/he is acting as the child's guardian.

- The caseworker will:

- Meet with the parent(s)/caretaker(s) and, using the DFS 543, gather all data requested therein concerning both parents (a separate form is required for each parent. A separate form can be completed for each child or one form may be used to list all children from the same household with the same parent(s). Place a copy in each child’s file.

- Forward immediately the original(s) copy of the DFS 543 form(s) to the Benefit Specialist.

- When the case is completed (approved or denied for IV-E), the Benefit Specialist will forward the 543 to CSE.

- Provide child support forms and evidence to the Benefit Specialist when good cause for non-cooperation is being requested as the procedures in (1) - (2) will not apply unless good cause is denied.

- Complete the DFS 545/546 FC when claiming good cause for non-cooperation with the pursuit of child support due to:

- possible physical/emotional harm resulting to the child or custodial parent;

- child was conceived due to incest or forcible rape;

- legal action for adoption is pending in court;

- parent is receiving counseling to help decide whether to keep or relinquish child for adoption;

- a court determination that parents would be unable to comply with an established reunification plan due to the financial hardship caused by paying child support; (only a judge decides if payment would be a hardship)

- termination of parental rights (TPR) is imminent and is part of the permanency plan or TPR has been completed;

- the non-custodial parent is a potential placement resource;

- death of the parent(s) with verification;

- child is expected to be in foster care for only a short period of time (60 calendar days or less).

- Provide to DFS-SO evidence and/or a written statements to support the good cause claim within 20 days of the claim;

- Realize the good cause claim approval/denial will be determined by DFS-SO POWER Unit for items a – d and f – i above.

Only a judge can make a determination if payment will be a hardship for item e. - Realize a review of the good cause claim will be needed once every 12 months.

- Complete the DFS 545/546 FC when claiming good cause for non-cooperation with the pursuit of child support due to:

- The caseworker will:

- Child support forms must be signed by the appropriate manager or designee since s/he is acting as the child's guardian.

- Within 15 working days of removal or when DFS gains custody of the child, the caseworker will provide verification of the child’s US Citizenship, identity, and social security number.

- Within 15 working days of removal or when DFS gains custody of the child, the caseworker will provide Information for the entire removal household.

- Within 15 working days of removal or when DFS gains custody of the child, the caseworker will provide a Copy of the placement contract to verify daily/monthly payment rate.

- Court Orders/Judicial Determinations

- A copy of the first court order removing the child from the home must contain a judicial determination specifying “continuation in the home is contrary to the welfare of the child” or “is in the best interest of the child not to be in the home.”See attachment for example.

- Within 60 days of removal there must be a court order addressing “Reasonable Efforts” to prevent removal with the family. (Note: This language may be in the first court order. If not, it must be there by 60 days.)

- Upon receipt from the court, immediately give a copy of the order to the Benefit Specialist.

- Notify the Benefit Specialist immediately upon changes in placement and circumstances for the child. (Use form DFS 602)

II. Benefit Specialist Responsibilities

- Understand the Economic Assistance DFS-FO staff is responsible for:

- Receiving the application (SS 501A) with supporting declarations and verifications and

- notifying the IV-E specialist immediately via email that the child is in placement; and

- establishing and registering the Medicaid case on EPICS based on known information, i.e., RC, FC, CI. This begins the Placement Eligibility file for the child; and

- add all removal household members onto EPICS through the SEPA screen; and

- forwarding the application and any supporting documentation to the IV-E Specialist for eligibility determination. (DO NOT CARC the case.)

- The IV-E specialist will complete the IV-E eligibility determination on the computer system and process the placement case.

- If the case is found to be IV-E eligible the IV-E Specialist shall retain the case and CARC it to herself.

- If the case is not IV-E eligible, the IV-E Specialist denies (or EPICS auto denies depending on situation) the IV-E portion of the case the file will be returned to the originating office for ongoing case maintenance.

- After denial is completed on the IV-E portion of the EPICS case the IV-E Specialist sends the file back to the original office. Since the child is in placement, the Medicaid stays open as a Foster Care or Subsidized Adoption Medicaid case.

- The Benefit Specialist from the original office then maintains the Medicaid case for the child while the child remains in DFS custody. Follow the policy in the Medicaid Policy Manual for Foster Care Medicaid.

- Note: If the 60 days has passed and the worker cannot make the IV-E determination, place the child in the next Foster Care Medicaid group according to the Medicaid hierarchy (Table V). Maintain the file until IV-E eligibility is determined. Then follow 2. a or b.

- Processing the application and making an eligibility determination within 45 days from the date of removal for IV-E foster care (see note at end of this chapter);

- Determining eligibility for IV-E foster care when retroactive medical coverage is requested as medical services were required for the child prior to the date of application per the SS 611 form(s) submitted by the Caseworker;

- Forwarding the DFS 543 Child Support Referral form to CSE within five (5) days after IV-E eligibility is determined, when good cause is not requested.

- Forwarding the DFS 543, DFS 545/546FC and evidence within 20 days to DFS-SO when good cause for non-cooperation with child support is being claimed;

- Notifying the caseworker if additional information is needed to complete the eligibility determination;

- Notifying the caseworker concerning the action taken on the Economic Assistance portion of the foster care case.

- Receiving the application (SS 501A) with supporting declarations and verifications and

- Assist the caseworker in completion of the forms if the child was in a household eligible for benefits (POWER, SNAP, Medical, Child Care)prior to the placement and most of the documents of verification are in the agency file.

- Copy or scan the necessary documents for the case record. D. Review court orders for appropriate language and work with caseworkers when necessary to obtain court orders with the necessary findings.

III.Child Support Enforcement Responsibilities

- Provide each parent with a copy of the Financial Affidavit Form and advise each parent s/he must complete the form, attach copies of their last two federal income tax returns and their last two pay stubs. CSE will forward a copy of the completed Financial Affidavit to the Benefit Specialist.

- Require the parent(s) to obtain a copy of any existing court order requiring either parent to pay child support;

- Require the parent(s) to make an appointment with CSE within 20 days following the dispositional hearing as part of the family service plan or as ordered by the court.

- Send a copy of the court order to the Benefit Specialist whenever one is obtained.

IV. Child Support Compliance

Reference: Under AFDC 1996 45 CFR 232.11; 45 CFR 232.40 -.49 Family Services Manual Chapter Funding 6.2 Child Support for Child in Out-of-Home Care

- The Benefit Specialist will determine if the foster child meets the child support eligibility factor.

- Assignment of Rights to Support (SS 501 A), Report of Absent Parent Form (DFS 543) - Require the Office Manager or designee to complete the Assignment of Rights to Support by signing an Application (SS-501A) and to complete the Report of Absent Parent form (DFS-543) on each non-custodial parent of each eligible foster child and to show intent to cooperate or not to cooperate.

- Note: When a child goes home for a trial visit or is sent to a new placement, new 543’s are not needed. However, CSE does need to know when the placement changes including the new placement name and address.

- Good Cause Claim (DFS 545/546FC) and Good Cause ClaimProcess Require the guardian/caseworker to read and sign the Good Cause Claim form.

- Allow the guardian/caseworker the right to claim good cause requiring that one of the following circumstances exist:

- Cooperation in establishing paternity or securing child support is reasonably anticipated to result in physical or emotional harm to the child or custodial parent;

- The child, for whom support is sought, was conceived as a result of Incest or rape;

- Legal proceedings for the adoption of the child are pending before a court of competent jurisdiction.

- Receiving counseling to help decide whether to keep or relinquish child for adoption;

- A court determination that parents would be unable to comply with an established reunification plan due to the financial hardship caused by paying child support (only a judge can determine if there is a financial hardship):

- Termination of parental rights (TPR) is imminent and is part of the permanency plan or TPR has been completed;

- The non-custodial parent is a potential placement resource;

- Death of the parent(s); or

- Child is expected to be in foster care for only a short period of time (60 calendar days or less).

- Give the Good Cause Claim form (DFS 545/546FC) to the guardian/caseworker promptly upon request.

- Require the guardian/caseworker claiming good cause to provide evidence within twenty (20) days of signing the DFS 545/546FC.

- Upon receiving the evidence proceed as follows:

- Review the evidence;

- Recommend approval or denial of the good cause claim; and

- Give the reason for the recommendation by attaching a memo to the form; and

- Forward the DFS-543, DFS 545/546FC, evidence, recommendations and reasons to the DFS-State Office IV-E Benefits Specialist Consultant.

- Consider the foster care case to be:

- Exempt from cooperation when good cause is approved, and

- Required to cooperate when good cause is denied.

- Require a re-evaluation of approved good cause claims:

- This review is required at least once every twelve months as well as at any time requested by the DFS- State Office.

- Require current evidence when requested by the DFS-State Office; and

- Submit a memo to the State Office Benefit Specialist IV-E Consultant stating no change in circumstances, or if there has been a change, describing it and attaching the evidence when requested.

- Acknowledge child support will not attempt to establish paternity or collect support when the good cause claim is approved.

- Allow the guardian/caseworker the right to claim good cause requiring that one of the following circumstances exist:

- Child Support Distribution Process

Realize any child support collected for a foster care case will be used toward the maintenance costs for the child and only the excess over the cost of care is available to the child.

V. Medicaid

- IV-E children are categorically eligible for Medicaid and are coded FC.

- Non-IV-E children must have eligibility determined for Medicaid Assistance. Follow policy in the Equalitycare Eligibility Manual Section 1200.

- Refer to Chapter 3 R for details on determining and process Medicaid for child in DFS care.

VI. Confidentiality and Safeguarding Information

Confidentiality means all information about recipients and applicants is not to be discussed or released to anyone except with the client’s written request. The written request must specifically state what is to be discussed or released, who may receive the information, and the duration of the release.

- Information may be released on a need to know basis to the following agencies without a written agreement or consent of the client:

- Social Security

- Child Support Enforcement c. Employment Asset Division

- Inquiries from other states’ DFS offices

- Bureau of Indian Affairs (BIA)

- Low Income Energy Assistance Program (LIEAP)

- Department of Education h. Wyoming State Hospital

- Wyoming State Training School

- Court Orders

- An order for release of information to the court relieves DFS of any harm.

- Contact the appropriate State Office program manager with any questions about court orders.

- File the court order in the case file.

NOTES: Keep in mind that if the application is not received during the seven (7) day time period, the child may still be IV-E eligible if the application is received between the date of the removal and the time a child is no longer in DFS custody for a maximum of eight (8) quarters.

A case may be in IV-E pending status up to sixty (60) days if awaiting verifications. If pending is longer than 60 days, the case must be put into a state foster care situation. A case may be reverted back to IV-E if all eligibility factors are received and determined at a later date that the child would have been IV-E eligible at the time of removal

| WYOMING DEPARTMENT OF FAMILY SERVICES |

CHAPTER: 3 |

| IV-E Foster Care Policy Manual | SUBJECT: AFDC Eligibility Factors |

| POLICY NUMBER: IV-E–11-001 | EFFECTIVE DATE: 07/01/11 |

ELIGIBILITY FACTORS

References:IV-E - P.L. 104-193, as amended by P.L. 105-33; IV-E State Plan; 45 CFR 1355.20, 1356.21(b)(2) and 1356.22; 45 CFR 435.07

Eligibility for Title IV-E funding for foster care is linked to a child’s eligibility under Aid to Families with Dependent Children (AFDC), even though this program ceased July 1996 when Temporary Assistance for Needy Families (TANF) came into existence. For Title IV-E Federal funding, the child must be eligible for AFDC or would have been eligible according to the July 1996 standards had an application been made during the month the voluntary placement agreement was signed or the month the child was removed. There are some exceptions to following the AFDC policy which include assets, income and immigrants.

Benefit Specialist Responsibility

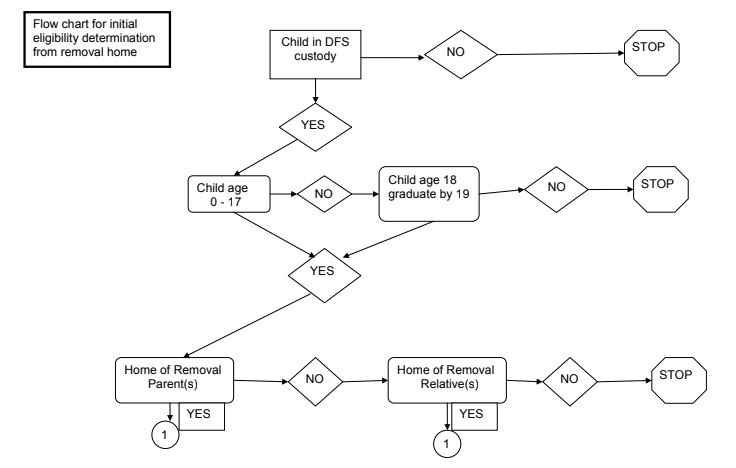

- Require the July 1996 AFDC eligibility factors be met using the household circumstances from which the child was removed pursuant to a voluntary placement agreement or judicial determination. The child must have lived in the removal home at least one month out of the six prior to removal. The child must continue to meet all of the AFDC factors in order to maintain IV-E eligibility throughout the placement episode.

- Use the information according to Information for the entire removal household.

- Determine the following eligibility factors: eligible persons, living with a relative, residence, age, school attendance, social security number, identity, citizenship, relationship, deprivation, assets, income, and child support compliance.

- Persons Eligible for inclusion in the IV-E Assistance Unit - 45 CFR 233.10, 233.20 and 233.90; W.S. 42-2-103 and W.S. 42-2-104

- Consider the following persons eligible when making the initial IV-E eligibility determination:

- A child;

- A natural or adoptive parent, including one who is married to a Stepparent;

- A caretaker relative;

- A stepparent with a natural, step or adopted child in the Home;

- The spouse and child(ren) of a parent, for up to three months following the parent's release from an Institution, including prison;

- The spouse and child(ren) of a convicted offender;

- A parent with a child who receives SSI;

- The child in the home of a parent receiving SSI;

- A minor parent who has a child.

- Consider the following persons ineligible when determining initial IV-E eligibility:

- The absent parent returning to the home when released from an institution, including prison;

- A stepparent unless the stepparent is the only caretaker relative in the home and is in need;

- An illegal immigrant;

- A person(s) who is ineligible due to a Lump sum Payment;

- A child for whom adoption assistance payments are provided. This exclusion does not apply if excluding the child from the assistance unit would reduce the AFDC benefits;

- A person participating in a strike, and when:

- The striker is the caretaker relative, the entire family is ineligible; or

- The striker is an eligible child, only that child is ineligible.

- A nonqualified immigrant (See Attachment 1 for Qualified Immigrant information)

- Consider the following persons eligible when making the initial IV-E eligibility determination:

- Living With A Relative - The child must have lived with the caretaker relative from whom custody was judicially taken or voluntarily given to the State during the eligibility month or within any of the six months prior to the eligibility month.

- A caretaker relative is a relative with whom the child lives and who has ongoing responsibility for the care of the child.

- A caretaker relative includes any of the following:

- Natural parent, adoptive parent, stepparent.

- Brother or sister, including step-brother/sister, half-brother/sister, and adoptive bother/sister

- Aunt or uncle

- Nephew or niece

- Any blood relative, including those of half-blood. First cousins, nephews and nieces and persons of preceding generations denoted by prefixes of grand, great or great-great are included in this definition.

- Ineligible - Find the "living with a relative" factor not met when:

- It cannot be established the caretaker relative is the primary caretaker of the child;

- The parents share joint custody and it cannot be established which parent is the primary caretaker; or

- All eligible children or the caretaker relative are expected to be out of the home for more than 30 days and the temporary absence criteria is not met.

- A caretaker relative is a relative with whom the child lives and who has ongoing responsibility for the care of the child.

- Residence - Require each person to be a resident of Wyoming.

- Consider a person a resident of Wyoming, who:

- Is living in the state voluntarily, with the intention of making the individual's home here and not for a temporary purpose; or

- Entered Wyoming with a job commitment or seeking Employment (whether or not currently employed).

- Recognize a lack of a permanent dwelling or lack of a fixed or home address may not act as a barrier to receipt of AFDC as long as residence is met.

- Consider a person a resident of Wyoming, who:

- Age

Require the child to be between birth and less than age 18; or at age 18, when attending school full-time and expected to graduate before reaching age 19. - School Attendance - Require the child, upon attaining the age of 18, to be enrolled full-time in high school or an equivalent course of study and reasonably expected to graduate prior to her/his 19th birthday. Assure that school age children are full-time students. Verify school attendance each Spring and Fall semester and more frequently if attendance is questionable.

- School attendance is defined by the school as full-time elementary or secondary (high school) and the child is enrolled or in the process of enrolling. School can include home schooling or independent study as defined and approved by the state and local school district.

- A child does not need to meet this education requirement if the child is incapable of attending school due to a documented medical condition.

- Social Security Number (SSN) - Understand the child is not required to meet the social security number factor to be eligible for reimbursement of the IV-E maintenance payment, but it is a requirement for receipt of Title XIX benefits and reimbursement of same. The SSN does not have to be verified, but a number is required. Best practice is to verify the number whenever possible to avoid duplication and misuse of the number. Always verify the number when there is a discrepancy or conflicting information.

- Identity (See Attachment 2 for acceptable evidence of identity.) - Require each individual to provide identification before finding the person eligible. To establish identity a document must show evidence that provides identifying information that relates to the person named on the document.

- Citizenship (Refer to Attachment I and 2)

- To be IV-E eligible, a child must be either a United States citizen by birth or naturalization, or must be a qualified immigrant. U.S. citizenship of a child follows that of the child’s U.S. citizen parent(s) or is established by being born in this country. Children who are in the U.S. under a visitor or tourist visa or under a student arrangement are not IV-E eligible. See Attachments 1 and 2 for acceptable verification of citizenship. When primary evidence is not available, two (2) pieces of secondary evidence is needed.

- Written Affidavit

- Affidavits should ONLY be used in rare circumstances.

- There must be at least two (2) affidavits by two individuals who have personal knowledge of the event establishing the applicant’s or recipient’s claim of citizenship. (The two affidavits could be combined into a joint affidavit)

- At least one of the individuals making the affidavit cannot be related to the applicant or recipient.

- Neither of the two individuals can be the applicant or recipient In order for the affidavit to be acceptable the person making them must be able to provide proof of their own citizenship and identity.

- If the individual(s) have information which explains why documentary evidence establishing the applicant claim or citizenship does not exit or cannot be readily obtain, the affidavit should contain this information as well.

- The State must obtain a separate affidavit from the applicant/recipient or guardian/representative explaining why the evidence does not exit or cannot be obtained.

- The affidavits must be signed under penalty of perjury.

- Qualified Immigrant status must be verified through the Citizenship and Immigration Services verification process utilizing the information on the Alien Registration Card designated as I-94 or SAVE.

- If a qualified immigrant foster child does not meet IV-E eligibility requirements, the child is not eligible for Medicaid for five years unless the child entered the United States before August 22, 1996, if the child qualifies for one of the protected classes of persons, or if the child becomes a naturalized citizen. See Combined Policy Manual at Chapter 606.

- Parents of children taken into custody must meet the citizenship/immigration requirements for initial eligibility. Those who do not meet the citizenship/immigration requirements as outlined in Attachment 1 will be considered illegal immigrants and have their income and assets deemed. All their assets will be counted to the household unit. Their income will be prorated by the number of persons in the household unit.

- Relationship - Determine if the applicant/recipient meets the relationship eligibility factor by requiring the caretaker of the removal home to be a relative to the child.

- Deprivation (Form SS 615) - The child must continue to be deprived of parental support. A determination of deprivation is always made in relation to the child’s parent. Under no circumstances does the State look to the legal guardian to determine deprivation. Require at least one of the deprivation factors listed below to exist for the child using the home of removal during the past six (6) months:

- death,

- absence (abandonment, separation, divorce, incarceration), physical or mental incapacity (only applies to 2-parent family),

- unemployment of the principal wage earner (only applies to 2-parent family), or

- termination of parental rights.- Continued Absence - Find the deprivation factor met when it is established continued absence exists because the proof that the non-custodial parent is not living in the home and cannot be counted on to function in the planning for the physical care, guidance and maintenance of the child has been verified.

- Eligible - Find the deprivation factor met when the caretaker relative of a child:

- Gives the reason for the absence of the non-custodial parent, such as death, desertion, abandonment, separation, never married or divorced; and

- Names the non-custodial parent or when the non-custodial parent is unknown, gives an explanation of the reason why the parent is unknown; and

- Provides two forms of evidence that establishes the non-custodial parent's residence elsewhere; and

- When Joint custody exists, the applicant/recipient has provided proof of being the primary caretaker.

- Ineligible - Find the case ineligible, when:

- The non-custodial parent is expected to return within 30 days; or

- Both parents are living with the child at the same time whether they are married or not, unless one parent qualifies due to incapacity or unemployment; or

- The preponderance of evidence indicates the non-custodial parent is in the home; or

- Joint custody is equally split between the parents and no primary caretaker exists; or

- The absence was caused only for the performance of active duty in the Armed Services of the U.S.; or

- The absence was caused solely by reason of employment, school, or training.

- Find the caretaker relative ineligible when she/he refuses to name the non-custodial parent or explain why the name is not known.

- Eligible - Find the deprivation factor met when the caretaker relative of a child:

- Convicted Offender - Find the deprivation factor met when one spouse of an intact family is incarcerated.

- 2-Parent Family Incapacity - Require incapacity of a parent to exist in a two parent family (not to include a stepparent unless there is a child in common) situation.

- Find a family to meet the deprivation factor when one or both parents receive Social Security Disability or SSI benefits.

- Require the incapacitated parent to pursue and accept other benefits for which the child may be eligible.

- Require a person not receiving Social Security Disability or SSI benefits to obtain a Report and Determination of Incapacity (DFS-110) and have it completed by a licensed physician for physical incapacity, a licensed mental health professional for mental incapacity or from a Medical professional supervised by a licensed physician or mental health professional.

- Review the Report and Determination of Incapacity (DFS-110).

- Accept the written recommendation from the medical professional when it is clear.

- Require further information from the medical professional when the recommendation is unclear.

- Authorize approval or denial of the case.

- Issue the notice of action of the eligibility determination.

- Require a new DFS 110 prior to the recovery date indicated by the medical professional and any other requested information (i.e., a progress report from DVR) to conduct a reevaluation of the incapacity.

- Find the 2-parent family potentially eligible after recovery from the incapacity for up to three payment months (when all eligibility factors are met) immediately following recovery, which may occur before the re-evaluation is due.

- Unemployed Parent (Applies to 2-parent family only) - Determine if “unemployment” can be used as a deprivation factor if the household from which the child was removed would have been eligible for AFDC-UP in the month of removal.

- The principal wage earner (PWE) must meet the following requirements.

- The applicant PWE must be working less than 100 hours in a month, or

- If working more than 100 hours, the employment must be of an intermittent nature and the excess is of a temporary nature. The fact that the PWE was under the 100 hour standard for the prior two months and is expected to be under the standard during the next months is considered evidence that the work is of a temporary nature.

- Determine the PWE is the parent who earned the most gross income in the family unit as demonstrated by tax and wage information from the previous two years (24 months) starting with the month prior to removal. Client statement can be accepted when no other evidence is available. If both parents earned exactly the same amount of gross income, the worker must designate the PWE.

- The principal wage earner (PWE) must meet the following requirements.

- Continued Absence - Find the deprivation factor met when it is established continued absence exists because the proof that the non-custodial parent is not living in the home and cannot be counted on to function in the planning for the physical care, guidance and maintenance of the child has been verified.

- Assets (P.L. 106-169, eff. 12/14/99; limit is $10,000.00); Countable assets of the assistance unit cannot exceed $10,000 during the removal month. Assets are defined as anything that a person possesses or owns that can be turned into cash. Assets must be available, which mean that a member of the assistance unit owns it or has the legal right to sell it or dispose of it for the individual’s own benefit. An asset is determined by its equity value, which is the current market value minus any legal debts still owning on the asset. Obtain appraisals when the value causes ineligibility and is disputed by the applicant/recipient. Assets of the home of removal only need to be verified when questionable or contrary to current information within the community or DFS.

- Countable Assets

- Agreement in escrow - use the principal in the escrow account (other than HUD/FSS) and subtract any legal encumbrances.

- Antiques - use the lower of two reasonable appraisals of the fair market value and subtract any legal encumbrances.

- Automobile (Motor Vehicle) -

- Use the Edmund’s book average trade in figure, or

- Use the lower of two reasonable appraisals of the fair market value, and

- Subtract any legal encumbrances, and

- Exempt $1,500 equity value for one vehicle only.

- Bona fide funeral agreement or burial contract - use the cash value as stated on the agreement/contract by the company/agency minus the exempt $1,500, plus accrued interest. Do not exempt other assets designated for burial purposes.

- Cash - use the applicant's/recipient's written statement.

- Certificates of deposit, stocks and bonds - use the cash value and subtract any legal encumbrances.

- Checking and saving accounts - use the cash value and subtract any legal encumbrances. When exempt and nonexempt funds are commingled in one account, the account is nonexempt.

- Collectibles - use the lower of two reasonable appraisals of the fair market value and subtract any legal encumbrances.

- Contract for deed, notes and mortgages - use the unpaid principal.

- HUD escrow account - use the cash value of the account when the family is no longer receiving housing assistance and the account becomes available.

- Income tax refund - use the refunded amount.

- Inheritance - use the cash or fair market value.

- Insurance settlement for property damage - use the cash value of the settlement when it is received in the month of removal and it is not used for replacement or repair as intended.

- Land and buildings (see Real property) -

- Use the lower of two reasonable appraisals of the fair market value, and

- Subtract any legal encumbrances, and

- When jointly owned and available, divide the remainder by the number of owners.

- Life Estate -

- Use the lower of two reasonable appraisals of the fair market value of the property; and

- Subtract any legal encumbrances; and

- When jointly owned and available, divide the remainder by the number of owners.

- Life insurance - use the cash value amount.

- Livestock, farm machinery and tools - use the lower of two reasonable appraisals of the fair market value and subtract any legal encumbrances.

- Mineral rights (water, gravel, oil, gas, etc.) -

- Use the lower of two reasonable appraisals, and

- Subtract any legal encumbrances, and

- When jointly owned and available, divide the remainder by the number of owners.

- Motor vehicles, boats, campers, trailers, mobile homes, motorcycles, etc.(see automobiles) - after the exemptions have been allowed for an automobile or income producing property, use the NADA or appraisals to determine value and subtract any legal encumbrances.

- Pension plan/Retirement funds - use the cash value stated by the employer or company. The portion of the pension plan/retirement fund paid by the client is an asset when withdrawn.

- Personal property - use the lower of two reasonable appraisals of the fair market value and subtract any legal encumbrances.

- Real property - determine the equity value and test against the asset limit when the real property is not exempted as a home or under the bona fide effort to sell.

- Refund of utility deposit - use the cash value stated by the utility company.

- Reimbursement - use the amount repaid to the client, as stated by the payer.

- Trust funds - use the cash value unless the person, other than the parent who created the trust and/or the Trustee, provides a written statement that it cannot be made available to meet day to day needs.

- Wyoming Uniform Gift to Minors Act (WS 34-13-117) - use the amount in the account unless the financial institution provides a statement of a lesser amount available due to a penalty.

- Exempt the following assets:

- Advanced Earned income Credit (AEIC) - in the month received and the following month. Any remaining portion shall be considered a nonexempt asset in the third month.

- Agent Orange Settlement Fund - payments made from this or any other fund established pursuant to the settlement in the "In Re Agent Orange" product liability litigation.

- Alaska Native Claims Settlement Act (ANCSA) - payments received from a Native Corporation established pursuant to ANCSA to include:

- Cash retained after the month of receipt to the extent it does not exceed $2,000 per individual in total; and

- Stock (including stock issued or distributed by a Native Corporation as a dividend or Distribution on stock); and

- A partnership interest; and

- Land or an interest in land(including land or an interest in land received from a Native Corporation as a dividend or distribution on stock); and

- An interest in a settlement trust.

- Aleutian and Pribilof Island Restitution Act - payments received by Aleuts under this Act.

- Automobile – the first $1,500 Equity value of one automobile;

- Bona fide funeral agreement, burial trust or contract – a formal agreement, burial trust or contract of no more that $1,500 for each person in the assistance unit as follows:

- Exempt the $1,500 and any interest which may accrue, and

- Count any equity Value over the $1,500 for each person against the appropriate asset limit, and

- Consider any money withdrawn from the principal or interest as nonexempt income when used for a purpose other than burial expenses.

- Do not apply this exemption to other assets designated for burial purposes.

- Burial plot – one for each person in the assistance unit.

- Child Support – the first $50 of child support for the current month paid to or kept by the assistance unit during the month received.

- Civil Liberties Act of 1988 – payments received by individuals of Japanese ancestry under this Act.

- Earned Income Credit (EIC) - in the month received and the following month. Any remaining portion shall be considered a nonexempt asset in the third month.

- Home – which is the current place of residence including the building and land upon which it is located, the land that appertains the home and all the buildings and/or mobile homes located thereon.

- Household furnishings – those essential to day-to-day living.

- HUD escrow account – accounts established under the Family Self- Sufficiency Program for participants receiving housing assistance.

- Income producing Property – of a self-employed client such as merchandise and inventory, tools, equipment, vehicles, etc., excluding Real property such as rental property, business property and farm land. If the applicant/recipient is unemployed, she/he must be reasonably expected to return to that line of work before the exemption can be applied.

- Indian lands and property - when purchased with exempt per capita funds.

- Insurance settlements for damaged property - for a period of 90 days after receipt or until the client makes a decision not to repair or replace the property, whichever happens first. When the insurance settlement is not used for replacement or repair, it is to be considered a lump sum payment.

- Loans/Educational loans - proceeds from exempt loans or exempt educational loans, grants or scholarships when not commingled with nonexempt moneys.

- Per capita funds - those distributed to or held in trust for members of any Indian tribe under Public Law 92-254, 93-134 or 94-540. s.

- Property -

- That has a barrier to sale;

- That is not available;

- Of an SSI recipient, an ineligible stepparent, ineligible parent(s) of a minor parent, ineligible caretaker relative (other than a parent) and child(ren) not in the assistance unit.

- Radiation Exposure Compensation Act - payments from this Act which was enacted October 15, 1990.

- Real property - for up to six months when the family is making a bona fide effort to sell the property for no more than current market value.

- Student financial assistance - all student financial assistance provided under programs in Title IV of the Higher Education Act or under Bureau of Indian Affairs student assistance programs when NOT commingled with other moneys.

- Ownership - Consider the nonexempt asset when it is owned by the parent, the eligible caretaker relative or the eligible child(ren).

- Available - Consider the ownership of a countable asset as available/accessible unless a legal barrier or restriction exists.

- Assume ownership and availability when the document shows it is owned solely by the applicant/recipient.

- Consider the asset, or a portion of the asset, available when the applicant/recipient can withdraw funds, sell the asset or owned interest in the asset or dispose of the asset in any way.

- Consider the asset available when the asset is owned by more than one person but the applicant/recipient can access the asset, or a portion of the asset, without the permission of the co-owner even when a statement of refusal to sell is furnished.

- Consider the asset unavailable when the document, signature card, etc., stipulates that more than one signature is needed to withdraw or convert all or part of the asset to available cash.

- Acquired Assets - Consider assets acquired during a month which exceed the asset limit to cause ineligibility for the same payment month.

- Sponsor of Immigrant - Refer to Combined Policy Manual 606 K for allocation of a Sponsor’s assets.

- Transfer Of Asset - The transfer of an asset will not apply during initial application determination for the home of removal. An asset transfer will apply after initial application if the child transfers a nonexempt asset for less than fair market value to gain or continue IV-E eligibility for reimbursement.

- Exempt Transfers - Exempt the following transfers:

- Settlement of a legally enforceable debt;

- Clearing title to property in which the client had no beneficial or enforceable interest;

- Property used as a home for another piece of property, to be used as a home (see 9., Exchange of Home Property);

- Equity in property which was owned jointly, and through a court action the other owner was granted the equity in the property; and

- An exempt asset (based on the status of the assets at the time of transfer).

- Nonexempt Transfers

- Determine the penalty for transferring the nonexempt portion of an asset when the applicant/recipient cannot provide proof the transfer occurred for reasons other than gaining eligibility.

- Determine the transferred Uncompensated Value and deduct the amount of the lien(s) and the unpaid principal of the mortgage or loan existing against the property to arrive at the uncompensated equity value.

- Determine the "Shelter included payment standard" for the household size at the time of the transfer.

- Divide the uncompensated equity value by the need standard. (Round a fraction up.)

- Use the resulting whole number as the number of months the child is ineligible, which cannot exceed six months.

- Require that the ineligibility begin with the month the transfer occurred.

- Exempt Transfers - Exempt the following transfers:

- Exchange Of Home Property - Allow an applicant/recipient to sell and buy or exchange ownership of a home for another home under the following conditions:

- Require a purchase contract or other evidence to establish the purchase.

- Require the exchange or home construction to be completed within six months from the date the contract was executed.

- Allow an extension of the six months upon approval of the DFS manager and document the approval in the case file.

- Exempt the proceeds from the sale until purchase, exchange or construction is completed or the six month period ends.

- Evaluate the assets upon completion of the exchange.

- When the old and new property are of equal value, there is no effect on eligibility.

- When the new property is of less value, consider the difference an asset.

- When the value of the new property is greater than the old property, establish where the additional money was obtained to evaluate as possible income or assets.

- Evaluate the assets at the end of the six months when the construction or exchange is not complete.

- Exempt the home into which the client is planning to move, and

- Count the balance of the proceeds from the sale of the previous home.