The Wyoming Homeowner Assistance Fund (HAF) Program includes help for:

- WYOMING HOMEOWNERS WITH MORTGAGE PAYMENTS: Help is available for past due payments for mortgage, partial claims, utilities, property taxes, homeowners insurance, and homeowners association dues. The HAF Program is now accepting applications to assist eligible homeowners with up to three months of consecutive forward mortgage payments. Priority will be as follows: mortgage reinstatement, partial claim assistance, delinquent “other expenses”, then forward mortgages.

- WYOMING HOMEOWNERS WHO OWN THEIR HOMES OUTRIGHT OR THOSE WITH REVERSE MORTGAGES: Help is available for past due payments for utilities, property taxes, homeowners insurance, and homeowners association dues.

Application Assistance

Please contact Liberty Smith, HAF Program Manager, directly at (307)-777-3737 or email homeowner.assistance@wyo.gov.

Documents

- Flyers: Download English version | Download the Spanish version

- FAQs for Homeowners: Download English version | Download Spanish version

- Housing Education Completion Form: If a homeowner owes more than $17,000 in arrears or cannot make payments moving forward, the HAF Program will require them to do housing education. The purpose of this letter is to notify the HAF Program that the client has successfully completed the required housing. Download the form.

- Bankruptcy Approval Letter: If you are filing for bankruptcy, we will need this letter signed by your attorney or servicer to ensure the servicer will accept HAF payments. Download the letter.

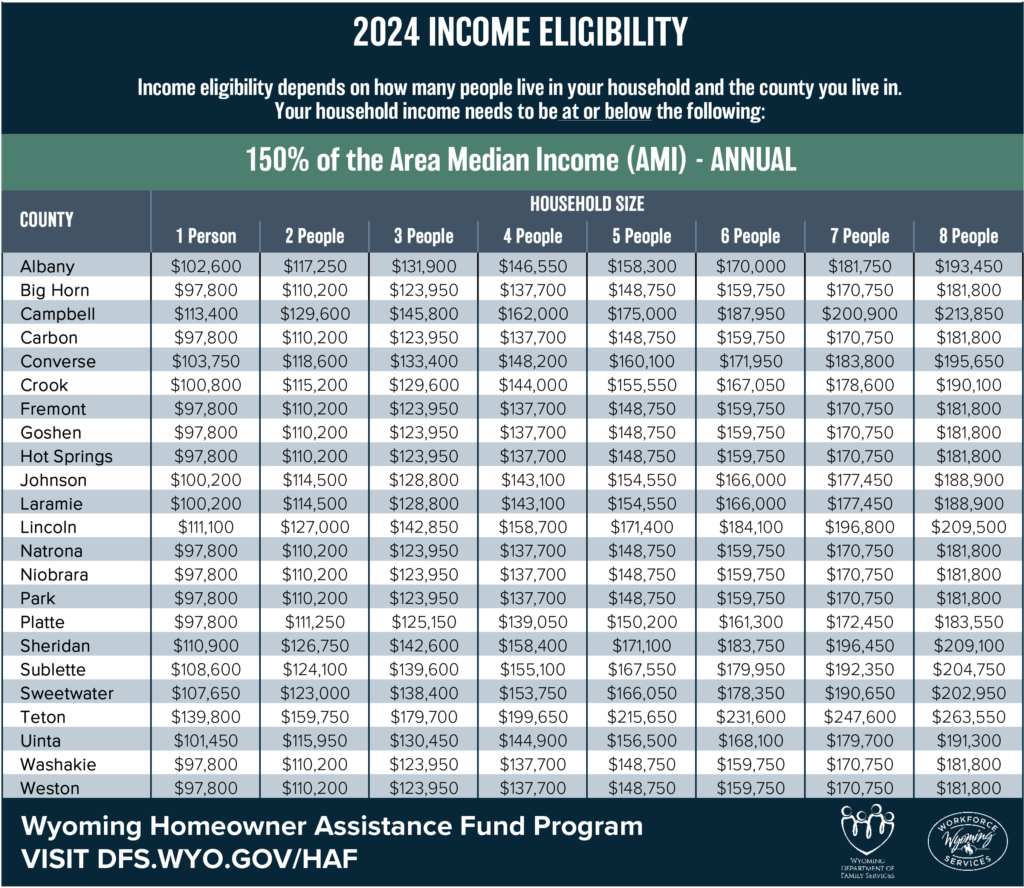

What is the income eligibility for the HAF Program?

You meet the income eligibility requirements for the HAF Program if your total annual household income is at or below 150% of the area median income (AMI). Your AMI depends on how many people live in your household and the county you live in. Please reference the table below to see the 2024 AMI applicable to your household. AMI limits are set by the U.S. Department of Housing and Urban Development and revised in April of each year.

Watch out for mortgage assistance scams

Please watch out for mortgage assistance scams. According to the U.S. Consumer Financial Protection Bureau, mortgage loan modification scams are schemes to take your money – often by making a false promise of saving you from foreclosure. The Federal Trade Commission explains that these scammers promise they’ll get changes to your loan so you can keep your home but they want you to pay them an upfront fee before helping you. Don’t pay an upfront fee. It’s illegal for a company to charge you upfront for promises to help you get relief on paying your mortgage.

RESOURCES

- Federal Trade Commission: Mortgage Relief Scams

- Consumer Financial Protection Bureau: What are mortgage loan modification scams?